K-Electric majority shareholder pushes for immediate board elections

- By Anjum Wahab -

- Nov 25, 2025

KARACHI: The majority shareholder of KE Holdings (KEH) has formally requested immediate elections for the K-Electric Board, stating that the board’s term, which ended in July 2025, has already expired.

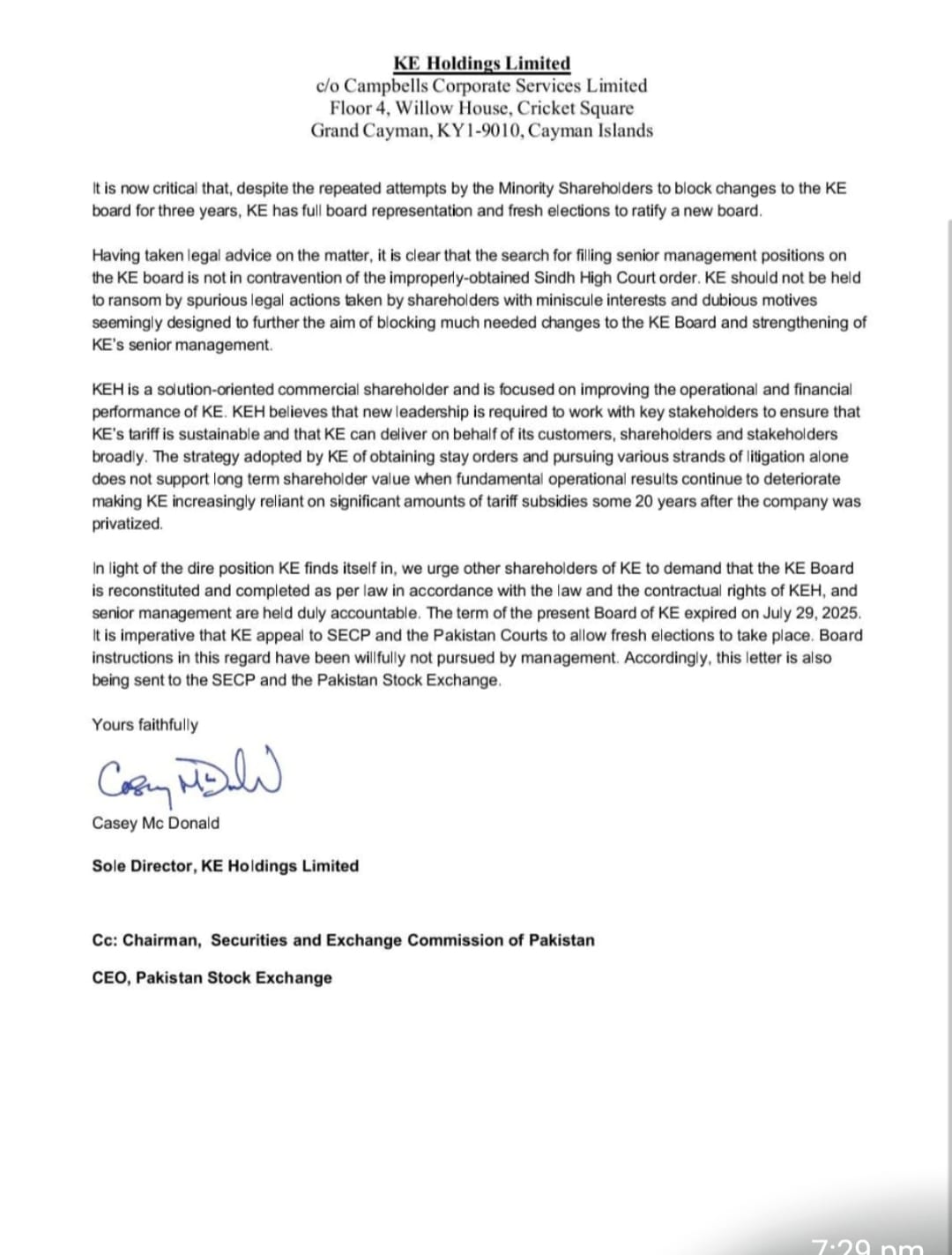

In an important letter, KEH Director Cas McDonald wrote to the CEO of K-Electric, the Chairman of the SECP, and the CEO of the Pakistan Stock Exchange, urging them to conduct fresh board elections without delay.

The letter states that KEH, the main shareholder of KES Power Ltd (Mauritius) and K-Electric Pakistan, holds 53.8 percent of KES Power, which in turn owns 66.4 percent of K-Electric. This gives KEH an indirect ownership of 35.7 percent, making it the largest shareholder.

KEH expressed serious concern over the recent conduct of K-Electric’s senior management, including the leaking of sensitive company information to the media and misreporting of board discussions and shareholder intentions.

The letter states that K-Electric’s leadership has lost the trust of key stakeholders, including the Government of Pakistan and NEPRA, and has failed to effectively pursue the company’s tariff appeals, causing financial harm to shareholders.

The letter further notes that K-Electric is a critical company for Karachi and Pakistan and cannot be left under the control of a minority shareholder group or a self-serving management.

According to KE Holdings, minority shareholders Aljomaih Power Ltd and Denham Investments Ltd have effectively paralysed board proceedings since 2022, when they obtained an interim order from the Sindh High Court.

That order left the board incomplete for three years until its term expired. KEH added that the Cayman Court of Appeal has termed the order inappropriate.

The KE Holdings (KEH) has urged that full board representation must now be restored and new elections held immediately. It said fresh leadership is essential to rebuild relationships with stakeholders, secure a sustainable tariff structure, and improve the company’s overall performance.