KSE-100 Index: PSX Report Today, Sept 20, 2024

- By Usman Hanif -

- Sep 20, 2024

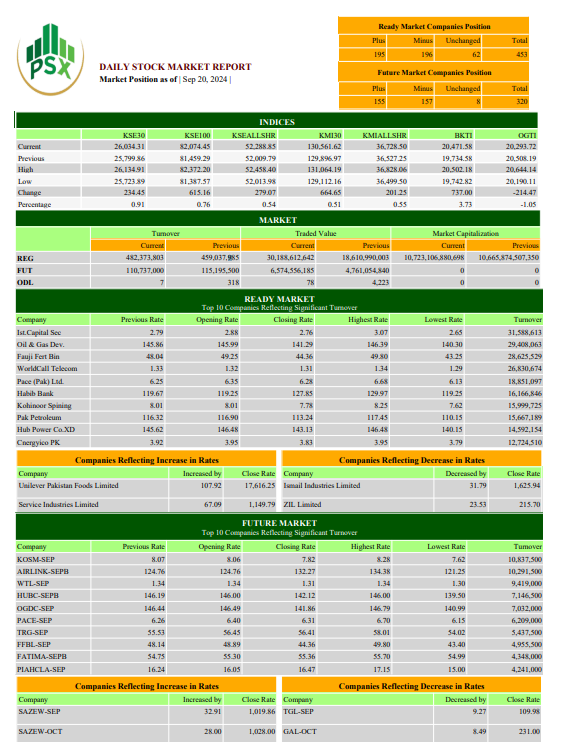

Pakistan Stock Exchange (PSX) benchmark index the KSE 100 Index has witnessed a historic day as the index surged to an all-time high, closing at 82,074.44 points.

This remarkable achievement was marked by a gain of 615.16 points, representing a 0.76% increase from the previous day. The PSX reached a peak of 82,372.19 points and a low of 81,387.57 points during the trading session.

Trading volumes were robust, with 482.37 million shares changing hands, amounting to a total value of PKR 30.188 billion. The number of trades executed stood at 229,192. According to Arif Habib Limited, this is the highest-ever closing for the KSE-100 Index, reflecting “strong investor confidence and positive market sentiment.”

The PSX opened with positive momentum and maintained a bullish trend throughout the session. The index hit a historic high of 82,004 points, closing the day with a significant gain of 998 points at 81,459 points, as per AKD research. Trading volumes saw a 24% increase compared to the previous session, indicating heightened investor activity.

Read More: Gold rates hit new record in Pakistan

A “rising window” pattern was observed, which typically suggests a continuation of the bullish trend. This is the fifth rising window in the last 50 trading sessions, further reinforcing the bullish outlook, of AKD research.

The KSE-100 Index of PSX closed the week at 82,074 points, reflecting a strong bullish trend typically seen in September, with a week-on-week gain of 3.36%, as per AHL Sales. Friday’s trading session was particularly active due to the Financial Times Stock Exchange (FTSE) rebalancing, with both domestic and foreign investors heavily buying.

On this day, 58 shares rose while 40 fell, with significant positive contributions from Habib Bank Limited (HBL) at 6.84%, Meezan Bank Limited (MEBL) at 4.61%, and MCB Bank Limited (MCB) at 4.15%. However, the index was dragged down by Oil and Gas Development Company (OGDC) at -3.13%, Hub Power Company (HUBC) at -1.71%, and Pakistan Petroleum Limited (PPL) at -2.65%.

With a substantial portion of foreign supply removed from the market and the index closing at new all-time highs, the outlook for the coming weeks is optimistic, according to AHL Sales. The market is now targeting the 86,000-point level, with key support rising to 80,000 points. This positive momentum is expected to continue, driven by strong investor confidence and favorable economic conditions.

Furthermore, the bullish close was driven by a combination of factors, including a significant drop in Pakistan Investment Bond yields by up to 335 basis points, attributed to receding inflation and improved liquidity, according to Ahsan Mehanti, CEO of Arif Habib Commodities.

This has raised expectations of a further cut in the State Bank of Pakistan’s policy rate. Additionally, robust economic data, including a $75 million current account surplus, rising remittances and exports, and stable rupee, played a crucial role in boosting investor confidence, he added.