PSX set to surge as KSE-100 targets 86,000 points post-IMF approval

- By Usman Hanif -

- Sep 25, 2024

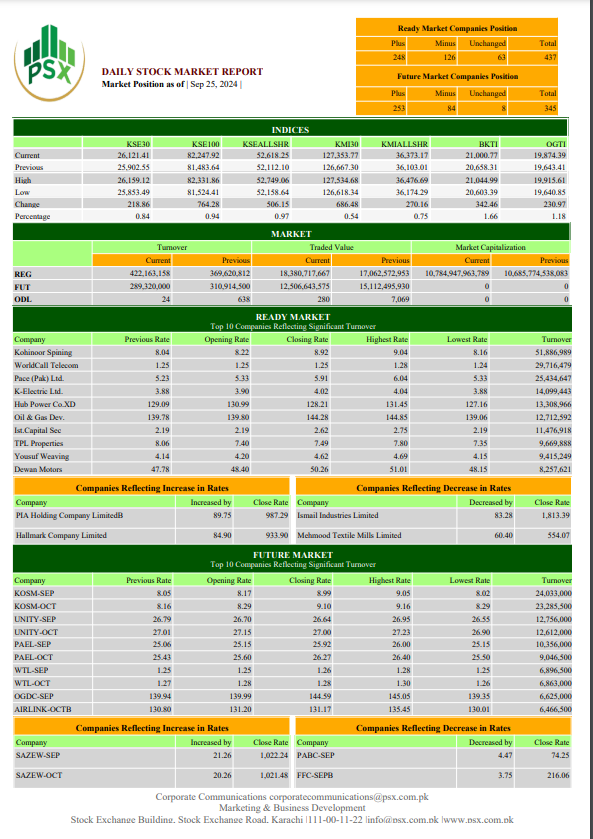

The KSE 100 Index, the benchmark index of the Pakistan Stock Exchange (PSX), concluded today’s trading session at 82,331.85 points, marking a significant increase of 764.27 points or 0.94%. The index experienced a high of 82,331.85 points and a low of 81,524.41 points during the session.

A broad wave of buying was observed, with major players such as MCB Bank Limited (MCB), Oil and Gas Development Company (OGDC), National Bank of Pakistan (NBP), United Bank Limited (UBL), and Bank AL Habib Limited (BAHL) making substantial gains. These key stocks collectively contributed 373 points to the overall rise, as reported by Topline Securities.

Trading activity at PSX remained robust, with a total volume of 422 million shares exchanged, amounting to a value of PKR 18.38 billion. The most actively traded stock was K-Electric Limited (KOSM), with 51 million shares changing hands.

The PSX’s positive momentum is attributed to easing political noise and speculation ahead of the International Monetary Fund (IMF) Executive Board meeting, which is expected to approve a USD 7 billion Extended Fund Facility (EFF) for Pakistan. This approval is anticipated to spur bullish sentiment and push the KSE-100 Index towards its target of 86,000 points.

Read More: Pakistan’s cutlery exports increase to $10.308mln

The session saw 72 stocks rise while 25 fell. Notable gainers included MCB Bank Limited (MCB) with a 4.8% increase, Oil and Gas Development Company (OGDC) up by 3.22%, and National Bank of Pakistan (NBP) rising by 5.35%. On the downside, Fauji Fertilizer Company Limited (FFC) dropped by 1.25%, Hub Power Company Limited (HUBC) fell by 0.68%, and Fauji Fertilizer Bin Qasim Limited (FFBL) decreased by 1.11%.

PSX’s Cement stocks also performed well, with Fauji Cement Company Limited (FCCL) up by 3.95%, Maple Leaf Cement Factory Limited (MLCF) rising by 3.05%, and D.G. Khan Cement Company Limited (DGKC) increasing by 1.87%.

According to AKD Research, the index opened with positive momentum and remained volatile throughout the session. The Bollinger Bands are currently 10.36% narrower than normal, indicating potential for increased volatility. The Moving Average Convergence Divergence (MACD) is bullish, trading above its signal line for the past 22 trading sessions.

The index may find initial support near 81,400 points, with further weakness potentially leading to 81,100 and 80,800 points. Resistance is expected near 81,800 points, with potential to reach 82,200 and 82,500 points.