PSX: KSE-100 Index shows robust momentum in September 2024

- By Web Desk -

- Sep 30, 2024

KARACHI: The Pakistan Stock Exchange (PSX) benchmark KSE 100 Index depicted robust momentum during September 2024 experiencing a notable rise, gaining 2,626 points, or 3.3% month-over-month, to close at 81,114 points.

At the start of the month, the announcement of single-digit inflation of 9.6% –a 34-month low– renewed investors’ expectations of a rate cut in the Monetary Policy Committee (MPC) meeting on September 12, 2024. Consequently, the State Bank of Pakistan (SBP) continued its monetary policy easing cycle, cutting the policy rate by 200 basis points (bps) to 17.5%, a move not seen since April 2020.

Moreover, a 50 basis points (bps) Federal Reserve (FED) rate cut also boosted market participation across Asian markets, including the local bourse, according to AHL report.

In addition to this, the International Monetary Fund’s (IMF) executive board (EB) meeting was held on September 25, 2024, in which the extended fund facility (EFF) worth USD 7 billion was approved. Later in the week, the first tranche of USD 1 billion was disbursed.

Read More: Pakistani rupee loses more value to the US dollar

This event resulted in the PSX’s KSE-100 Index reaching its highest-ever level of 82,248 points on a closing basis, according to AHL. However, subsequent profit-taking resulted in the market closing below the 82,000 level.

The SBP reserves reached the highest level since July 2022, amounting to USD 9.5 billion, up by USD 96 million month-on-month (MoM). Furthermore, the Pakistani Rupee appreciated against the US Dollar by PKR 0.82 or 0.30% MoM, settling at 277.71. The market culminated at 81,114 points in September 2024, showcasing a massive gain of 2,626 points or 3.3% MoM.

Average daily volumes during September 2024 settled at 527 million shares (down 2.1% MoM) at PSX, while the average daily traded value also decreased by 13.7% to USD 57.8 million, according to AHL. Foreign investors sold shares worth USD 49.9 million predominantly in fertilizer (USD 21.3 million), exploration and production (E&P) –USD 13.6 million, banks USD 8.6 million, cement USD 4.6 million, and other sectors USD 2.6 million, while net buying of USD 3.8 million was witnessed in the technology sector.

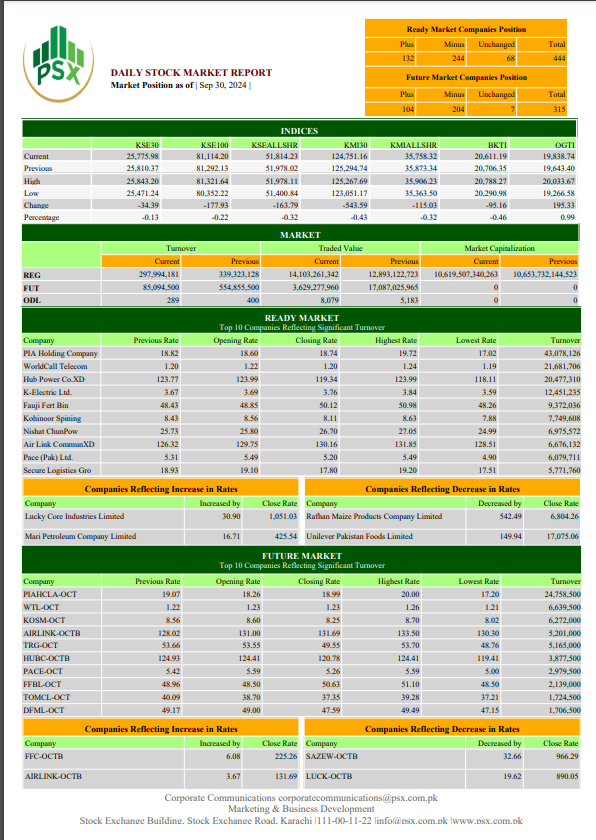

On Monday, The Pakistan Stock Exchange (PSX) closed at an index of 81,114.20, reflecting a decrease of 177.93 points or 0.22%. During the trading session, the index reached a high of 81,321.63 and a low of 80,352.22. The total trading volume was 297,994,181 shares, with a value of 14,103,261,342 PKR, spread across 190,704 trades.

Pakistan Stocks closed under pressure due to political uncertainty and foreign outflows, said Ahsan Mehanti, CEO of Arif Habib Commodities. Government action on independent power producers (IPPs) tariff, concerns over the outcome of tax collection shortfall, and delays over the privatisation of state-owned enterprises (SOEs) played a catalytic role in the bearish close.