PSX retreats 224 points as investors take profits

- By Usman Hanif -

- Sep 23, 2024

Pakistan Stock Exchange’s (PSX) benchmark KSE 100 Index closed the trading session at 81,850, reflecting a decrease of 224 points, or 0.27% owing to profit taking by the domestic and international investors.

The profit-taking at PSX was largely seen in Hub Power Company Limited (HUBC), Mari Petroleum Company Limited (MARI), Pakistan Petroleum Limited (PPL), Oil and Gas Development Company Limited (OGDC), and Bank Alfalah Limited (BAFL), which collectively contributed to a decline of 634 points in the index, according to Topline Sales Desk.

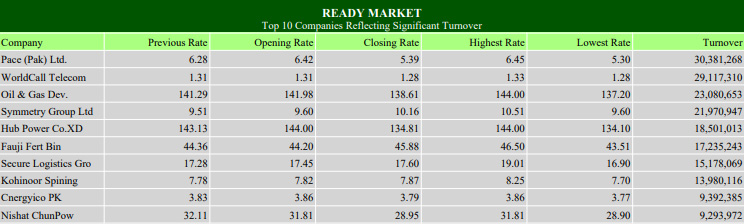

Trading activity remained robust, with 400 million shares traded, totalling Rs 18 billion. Pace Pakistan Limited (PACE) was the most actively traded stock, with 30 million shares exchanged.

Spillover selling from the Financial Times Stock Exchange (FTSE) rebalancing kept the market under pressure on Monday, Arif Habib Limited (AHL) report said. Forty shares rose while fifty-nine fell, with Fauji Fertilizer Company Limited (FFC) (+7.0%), United Bank Limited (UBL) (+3.4%), and Engro Fertilizers Limited (EFERT) (+2.78%) having the biggest upside index contributions.

Read More: Gold rates drop in Pakistan

HUBC (-5.81%), MARI (-5.98%), and PPL (-2.93%) were the biggest index drags, the AHL report added. OGDC (-1.9%) announced Fiscal Year 2023 Earnings Per Share (FY23 EPS): PKR 48.59, -7% Year-over-Year (YoY). Fourth Quarter Earnings Per Share (Q4 EPS): PKR 8.81, -42% YoY, which were below expectations. Alongside the result, the company announced a final cash dividend of PKR 4.00/share (PKR 10.10/share in FY24).

Hi-Tech Lubricants Limited (HTL) (-7.37%) announced a Fiscal Year 2024 Loss Per Share (FY24 LPS): PKR 0.99 compared to a loss of LPS: PKR 1.77 in FY23. On a quarterly basis, the company registered Earnings Per Share (EPS): of PKR 1.29 compared to a Loss Per Share (LPS): of PKR 0.48 in the same period last year, the AHL report said. KSE-100 is expected to find support around the 81,000 level from where 83,000 would be the near-term target.

The index opened with positive momentum and remained bullish throughout the session, AKD Research said. The Moving Average Convergence Divergence (MACD) is bullish since it is trading above its signal line. The MACD crossed above its signal line 20 trading sessions ago. Since the MACD crossed its moving average, the Index has increased 4.16% and has ranged from a high of 82,372 to a low of 77,990.

The PSX record shows that the index may find initial support near 81,800. A break below this support can result in further weakness towards the 81,400 and 81,100 points level, AKD Research said. Alternatively, the index can face resistance near 82,500 points initially and then head towards the 82,800 and 83,200 areas. AKD recommended initiating buying positions with risk defined below the support zone.