National Saving Schemes and the misconception

- By Azhar Khan -

- Jun 05, 2014

KARACHI: In the last 5-6 years and unprecedented growth in savings portfolio of National Saving Schemes (NSS) and particularly its double digit ratio versus GDP attracted the attention of all financial lizards inside and outside Pakistan particularly in the neighboring countries which also irritated multilateral and bilateral agencies. It not only reduced the dependency of government on the banks but also provided financial relief to the small investors’ particularly senior citizens and widows.

At the end of last fiscal year, according you State Bank of Pakistan NSS portfolio outperformed its debt services eluding a positive cash flow which provided substantial budgetary support and gave a strong signal about the self sufficiency potential of Pakistan.

Due to its unprecedented performance, various stakeholders tried to create a wrong perception that NSS is the main hurdle in promoting domestic debt market which is in fact the other way round for the following reason:

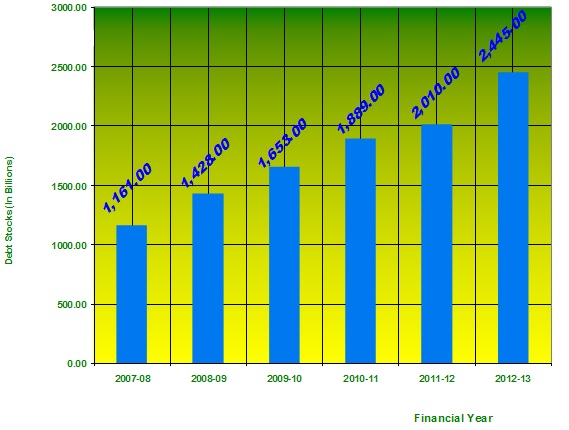

GROWTH OF NATIONAL SAVINGS IN 6 YEARS:

1. Rate offered to NSS is 5% less than what Government of Pakistan offered, mainly to national banks.

2. NSS is providing substantial support to curtail the banking spread which us one of the highest in Pakistan.

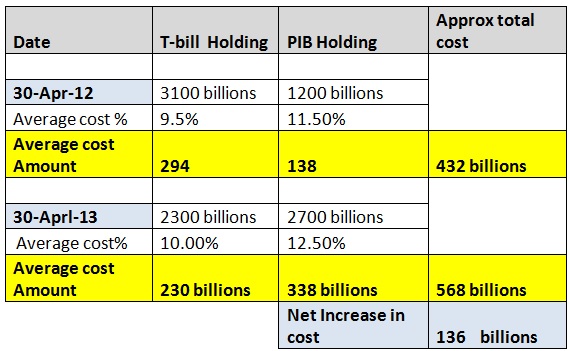

3. According to a study by ADB, cost of NSS for better than GOP borrowing in shape of TBills and PIB due to 20 to 30% pre encashment of NSS. Hence it’s a cost effective boring for GOP

4. Maturity profile suits to domestic debt portfolio

5. Contain inflation which is one of the cores of Pakistan economy.

6. Financial relief to Senior Citizens and Widows without incremental costs and Market based returns to all small savers

Coming back to the so-called allegation, it should be clarified that NSS should not be only treated as a borrowing agency but must raise long term funding for Government development projects like Bhasha Dam Munda Dam and realistic shariah compliance papers, sharing with Banks for eventual trading in all stock exchanges of Pakistan that will also help NSS and the Banks to invite common people to put their share in Government development projects and eventually it will curtail the currency in circulation which us again a core issue of Pakistan Economy. We should not forget that 3 years ago NSS was the first government agency to launch its tradable bonds on all stock exchanges of Pakistan.

Unfortunately NSS at sidelines due to various constraints compelled the government to raise its dependency on the banks and following chart indicates a paradigm shift in the domestic portfolio raising the cost of borrowing which will pressurize the budgetary supports.

Cost and maturity profile of Domestic Debt

Investment Risk and Other Points:

- In case of depict in interest rate, government of Pakistan will suffer a lot.

- Three years PBI effectively 2 years Plus offering KIBOR +2% to Government of Pakistan.

Under this scenario how they will lend their funds to the corporate and at what price?

- Banks have no such lucrative investment a risk and best return at the cost of exchequer.

Three years ago NSS standardized all SOPs ratified by SBP and other stakeholders to lunch its own dollar bond for non Resident Pakistanis offering them better rate of return on their hard earnings and at the same time, minimize the dependency of government on Multilateral and Bilateral agencies. But it could not be implemented for test.

From the above ground realities it is the need of the time to promote, strengthen and revamp NSS to become a single source of non-banks funding which will not only provide budgetary support for government but also promote saving to be channeled in promoting government development projects achieving the multiple economic goals including market base return to small saver particularly to senior citizen, widows and handicap peoples. – By a retired banking professional.